On January 1, 2024, a new federal law called the “Corporate Transparency Act (CTA)” took effect in the United States. This law applies to most American and foreign companies in the United States (USA) and must now file a declaration of beneficial owners (BOI). If the declaration is not filed on time, the consequences can be dire, up to a risk of imprisonment for two years.

Contents

What is the CTA?

The Corporate Transparency Act (CTA) aims to combat money laundering, terrorist financing, tax evasion, and other illicit activities involving anonymous entities in the United States.

The CTA requires all companies created or registered in the United States (both U.S. and foreign), except for specific exempt categories, to report to the Financial Crimes Enforcement Network (FinCEN), an agency of the U.S. Department of the Treasury, the following information about their beneficial owners:

- Name,

- Date of birth,

- Residential address,

- Unique identification number (passport number for foreigners),

- A copy of the passport is in JPG or PDF format.

What is a beneficial owner?

A beneficial owner is a natural person who, directly or indirectly, owns or controls 25% or more of the shares or voting rights of the entity or who exercises significant power over the management or affairs of the company. This may include, but is not limited to:

- Owners,

- Directors,

- Officers,

- Shareholders,

- Trustees,

- Partners.

How do I file the BOI report?

The beneficial ownership report must be filed using an electronic form called Beneficial Ownership Information (BOI), available on the FinCEN website.

When is the BOI report due?

The deadlines are stringent and vary depending on the date the company was formed:

U.S. companies formed:

- Before January 1, 2024: no later than January 1, 2025,

- Since January 1, 2024: no later than 90 days after the date of formation,

- From January 1, 2025: no later than 30 days after the date of formation.

Foreign companies registered:

- Before January 1, 2024: no later than January 1, 2025,

- Since January 1, 2024: no later than 90 days after the date of registration,

- From January 1, 2025, 30 days after the registration date.

A foreign company (incorporated outside the United States) is considered registered in the United States if it has obtained authorization to do business in one of the 50 states, the District of Columbia, or certain U.S. territories by applying with the Secretary of State of the relevant state or equivalent agency.

What are the implications of not complying with the CTA?

Failure to file a BOI declaration under the Corporate Transparency Act (CTA) can lead to serious consequences:

Civil Consequences:

- Maximum fine of $500/day,

- Court injunction.

Criminal Consequences:

- Company: Maximum fine of $50,000,

- Individuals: Maximum 2 years in prison and a maximum fine of $10,000.

Other Consequences:

- Prohibition from obtaining public contracts,

- Prohibition from acquiring licenses, permits, or registrations,

- Restriction of access to public loans and funding,

- Tainted reputation with business partners,

- Increased risk of audit and investigation by authorities,

- Closure of the compagny’s bank account.

Steps to take to file your BOI declaration

Gather all the information on the company and the beneficial owners

- Beneficial owner: Name, first name, date of birth, passport number, address, and passport copy.

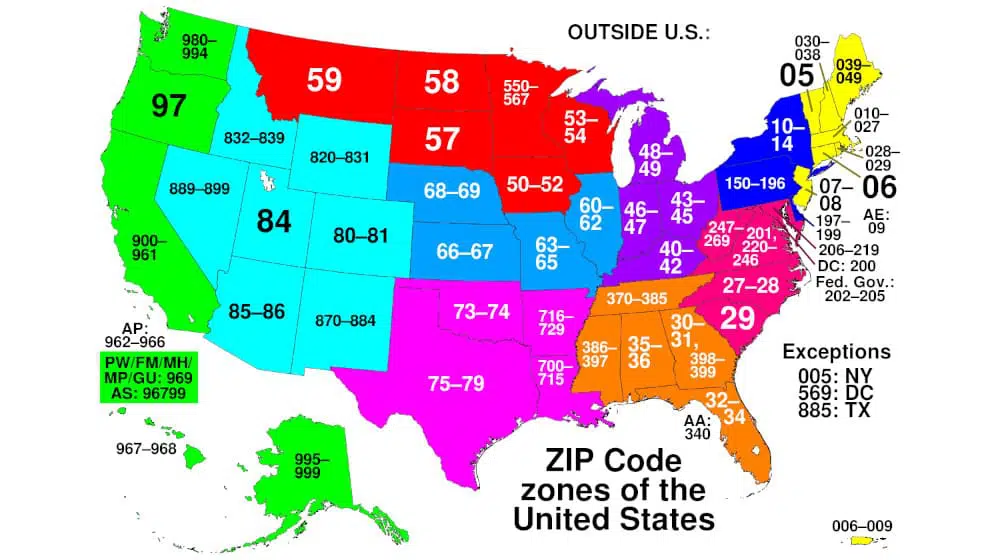

- Company information: Name, official address, tax ID, state postal code, etc.

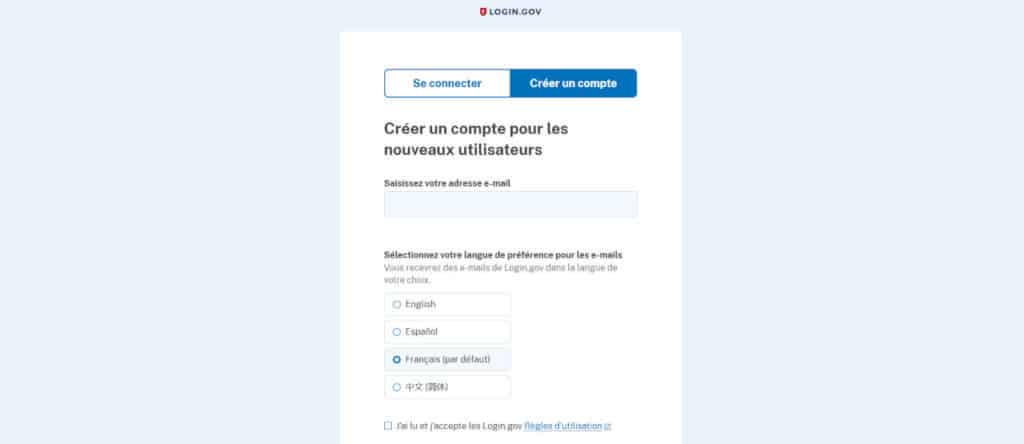

Create a Login.gov Account (Optional)

The first step is to create an account for the beneficial owner on the Login.gov website. It’s a secure platform the United States federal government uses to allow citizens, residents, and businesses to access various online services with a single account. The platform ensures strong authentication. It protects personal information while facilitating access to agencies such as the IRS, FinCEN, and health and social security services.

Please note that the platform works in French. Authentication uses Google Authenticator, and validation is done by SMS or email.

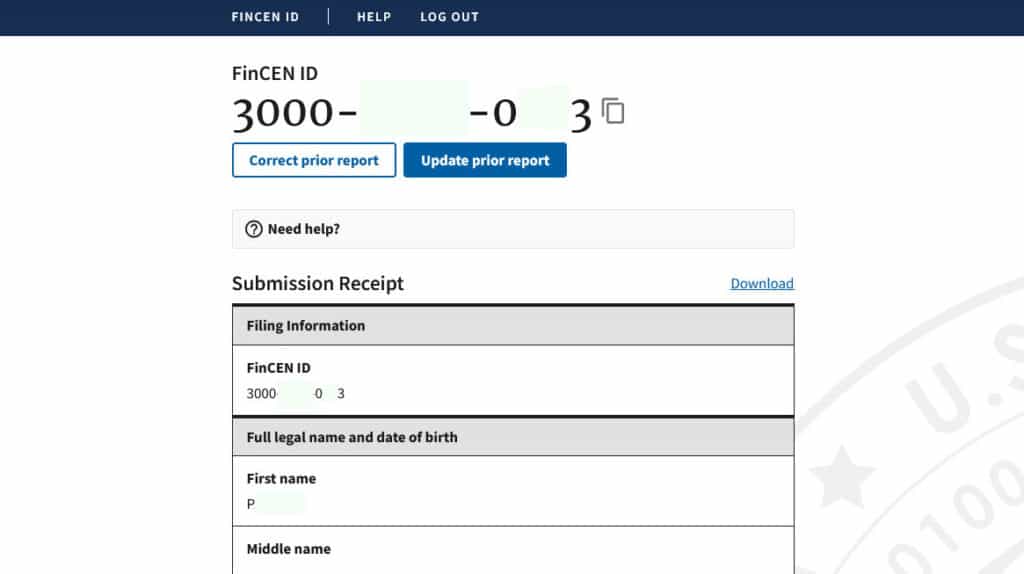

Retrieve a FinCEN ID

Once registered on the Login.gov platform, you can retrieve a FinCEN ID for each beneficial owner. You must identify yourself with your Login.gov account. You must provide your address, marital status, passport number, and a copy of your passport.

To obtain a FinCEN number, register on the website https://fincenid.fincen.gov/.

You will ultimately obtain a number of the types:

This FinCEN ID will subsequently be used to report beneficial owners. Please note that you must follow the same steps for each beneficial owner.

Filling out the BOI declaration of the American company

Once you have the beneficiaries’ “FinCEN IDs,” you can declare them beneficial owners. To begin, go to the dedicated page Declaration of Beneficial Owners and follow the instructions indicated:

Step 1: Filling information

In principle, at this step, you have to click on the “Initial Report” box, validate the current date, and click on the “Next” box:

Step 2: Reporting Company

At this stage, the critical points are:

- Check the box “Request to receive FinCEN ID.” After you complete your company’s declaration, you will receive a FinCEN ID. This will facilitate any changes and monitoring over time.

- Indicate the “Tax Identification number” essential to identify your company (without the hyphen). After filling it in, many boxes will be grayed out.

- Indicate the company’s address.

Step 3: Company applicant(s)

If your company existed before January 1, 2024, check the box. Then, all other information on the page will become grayed out.

Step 4: Beneficial Owner(s)

This is to fill in the CTA beneficial owners. If you have created a FinCEN ID for the beneficial owner, you only need to fill in their number. Otherwise, you must fill in the information manually.

Step 5: Submit

- Indicate the name, first name, and email of the reporting person.

- Verify the submitted data and submit the report.

- Keep a copy of the declaration for your internal records.

Official explanatory video on the Corporate Transparency Act (CTA) and the declaration of beneficial owners (BOI)

To help you better understand the importance of the CTA and the BOI declaration, we invite you to watch an explanatory video on the subject:

A tip: for those not sufficiently experienced with the English language, activate the automatic translation of the subtitles (bottom right).

Frequently Asked Questions (FAQ) on Beneficial Ownership Reporting for the Corporate Transparency Act (CTA)

Unconstitutionality proceedings of the law “Corporate Transparency Act (CTA)” in progress

The Corporate Transparency Act (CTA) is currently the subject of an unconstitutional procedure before the United States Supreme Court. In addition, with Donald Trump’s election, the law may be repealed in the coming months. But, given the risks, we invite you to file the declaration promptly.

Download the Corporate Transparency Act (CTA) law.

In addition, download the text of the law of the Corporate Transparency Act (CTA) in PDF format:

Download FinCEN’s FAQ on Beneficial Owners (BOI)

In the video, step by step, declare your beneficial owners :

In video: the suspension of the CTA

Other articles on administrative, financial, and tax information in the United States (USA)

We are interested in your opinion and advice on the declaration of beneficial owners about the Corporate Transparency Act (CTA):

Tell us in the comments. THANK YOU.